Do you use a car for your business that you own, lease or hire under a hire purchase agreement? Does your business operate as a sole trader or partnership (when at least a partner is an individual)? You can claim a deduction for the business use of your motor vehicle.

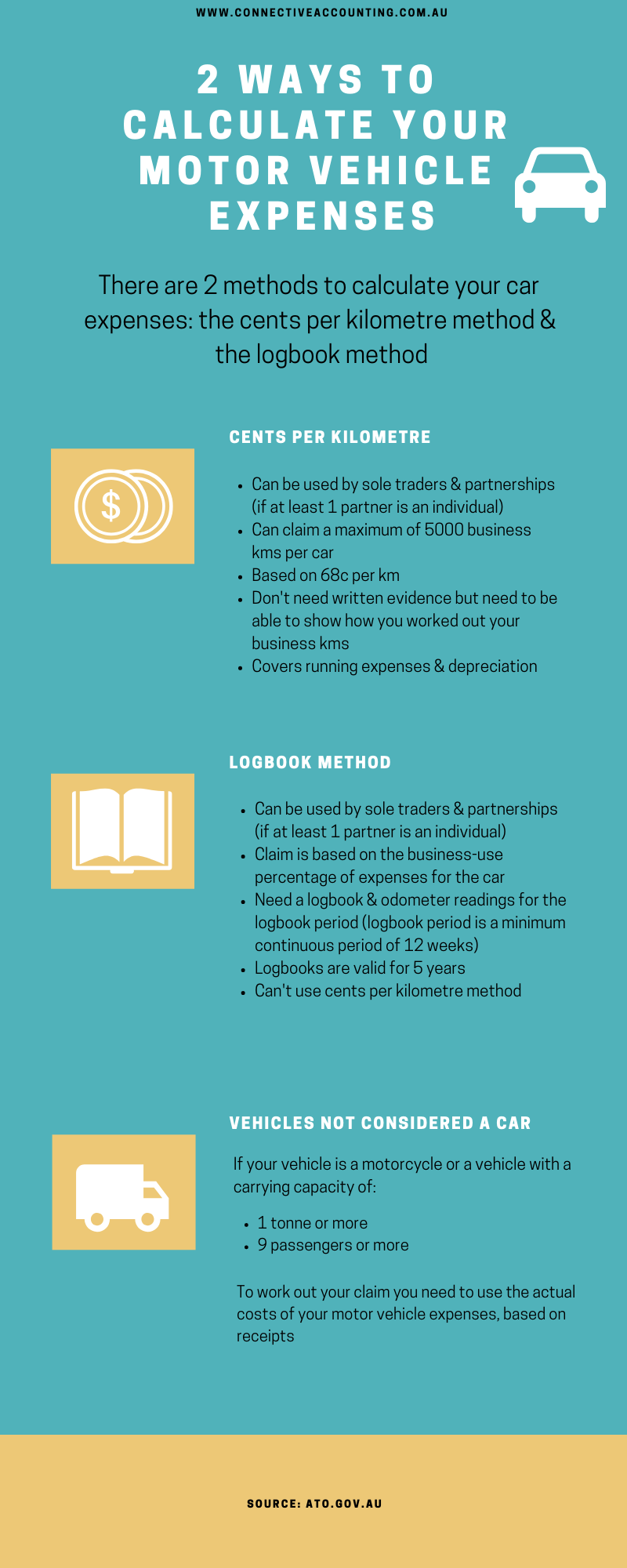

There are two methods for calculating your motor vehicle expenses for your claim: the cents per kilometre method and the logbook method. This month we are taking you through what you can claim and the difference between the two methods. Read on to find out all about claiming motor vehicle expenses.

What is a Car?

This is defined as a motor vehicle designed to carry:

Less than 1 tonne

Fewer than 9 passengers

This excludes motorcycles or similar vehicles. For motorcycles or other vehicles not defined as cars, you need to use the actual costs of your motor vehicles expenses (i.e. based on receipts) when making your claim.

For motor vehicles defined as cars, there are 2 methods you can use for claiming your motor vehicle expenses: the Cents Per Kilometre Method or the Logbook Method. We’ve outlined both of these methods below.

How Can I Work Out My Claim?

Our handy infographic below outlines the 2 different methods you can use for working out your motor vehicle expenses claim.

How Do I Record My Business-Related Car Expenses?

If you are using the Cents Per Kilometre method, you don’t need to provide written evidence, but you do need to be able to show how you worked it out (e.g. producing diary records of work-related trips).

If you are using the Logbook method, you will need to keep a logbook for a continuous 12 week period. If you use 2 or more cars for your business, you will need to keep a separate logbook for each car.

You can find a pre-printed logbook from places like Officeworks with all of the required information for you to fill out or you can go paperless by using the ATO’s free myDeductions tool which has an electronic logbook you can use from your smartphone or tablet. You can find out more about the myDeductions app and how to use it here.

Using the Logbook Method, you also need to have evidence of your fuel and oil costs, or odometer readings on which your estimates are based. You also need to have evidence for all your other car expenses.

How Do I Calculate My Work-Related Car Expenses Using the Logbook Method?

Once you have kept your logbook for a continuous 12 week period, you will need to divide the total amount of kilometres travelled during the logbook period by the number of kilometres you travelled for business during the logbook period. This will give you your business-use percentage. You then multiply this by your car expenses to figure out your claim.

Which Method Should I Use?

If you are claiming for more than 5000 business kilometres, you need to use the logbook method or claim the actual costs because you can only claim up to 5000 business kms with the Cents Per Kilometre Method.

Do you need more help working out your motor vehicle expenses claim? Connect with us today and we can help you!

- Apps 3

- Bookkeeping 23

- Cash Flow 6

- Cloud Accounting 17

- Compliance 12

- E-invoicing 1

- End of Financial Year 7

- Finance 4

- GST 1

- Growth 4

- JobMaker 1

- Money 12

- Payroll 2

- QuickBooks Online 18

- Receipt Bank 3

- Single Touch Payroll 5

- Small Business 43

- Superannuation 5

- Sustainability 1

- Working From Home 1

- Workload 9

- Xero 1