This month we’ve got all of your invoicing questions answered. If you’re not sure what you need to include on your invoices or if you’d like some tips on what to do when a customer doesn’t pay, read on. We’ve also got a few different methods for creating invoices, including a free tax invoice template for you to download.

What is an invoice?

A record of purchase that you give to your customers so that they can pay you for the goods or services you have provided.

When do I issue a tax invoice?

When you make a taxable sale of over $82.50 including GST. If a customer requests a tax invoice from you, you have 28 days to provide one.

My business isn’t registered for GST - do I still need invoices?

If your business isn’t registered for GST, you can use what is known as a regular (or normal) invoice. A regular invoice doesn’t include the tax component and therefore should not include the words ‘tax invoice’.

When should I give the customer their invoice?

It is a good idea to send your invoices out as soon as possible. The faster you send them out, the faster you will get paid. It also helps to send them when the value of your work is still fresh in their mind, so that they will be more inclined to pay you faster.

What do I need to include in my invoices?

The ATO says that if your business is registered for GST and the taxable sale is over $82.50 (inc. GST), you need the following 7 items on your invoices:

That the document is intended to be a tax invoice

The seller’s identity

The seller’s ABN

The date the invoice was issued

A brief description of the items sold, including the quantity (if applicable) and the price

The GST amount (if any) payable - this can be shown separately or, if the GST amount is exactly one-eleventh of the total price, as a statement such as ‘total price includes GST’

The extent to which each sale on the invoice is a taxable sale (that is, the extent to which each sale includes GST).

If the taxable sale is $1000 or more, you will also need to include the buyer’s entity or ABN.

My customer hasn’t paid their invoice, what can I do?

If your customer hasn’t paid their invoice, try:

Emailing through a payment reminder

Calling the customer to remind them

Sending out a statement

Chasing up payment can be an awkward process. To help encourage customers to pay on time, you can:

Include payment terms on your invoice (this doesn’t have to be 30 days - it can be whatever you think is reasonable. Invoices with shorter payment terms tend to be paid faster)

Offer multiple payment options - make it easy for them to pay

Make sure your invoices are easy to understand

Keep in contact with your customers

Consider introducing late payment fees or a reduced fee for early payment

How do I create an invoice?

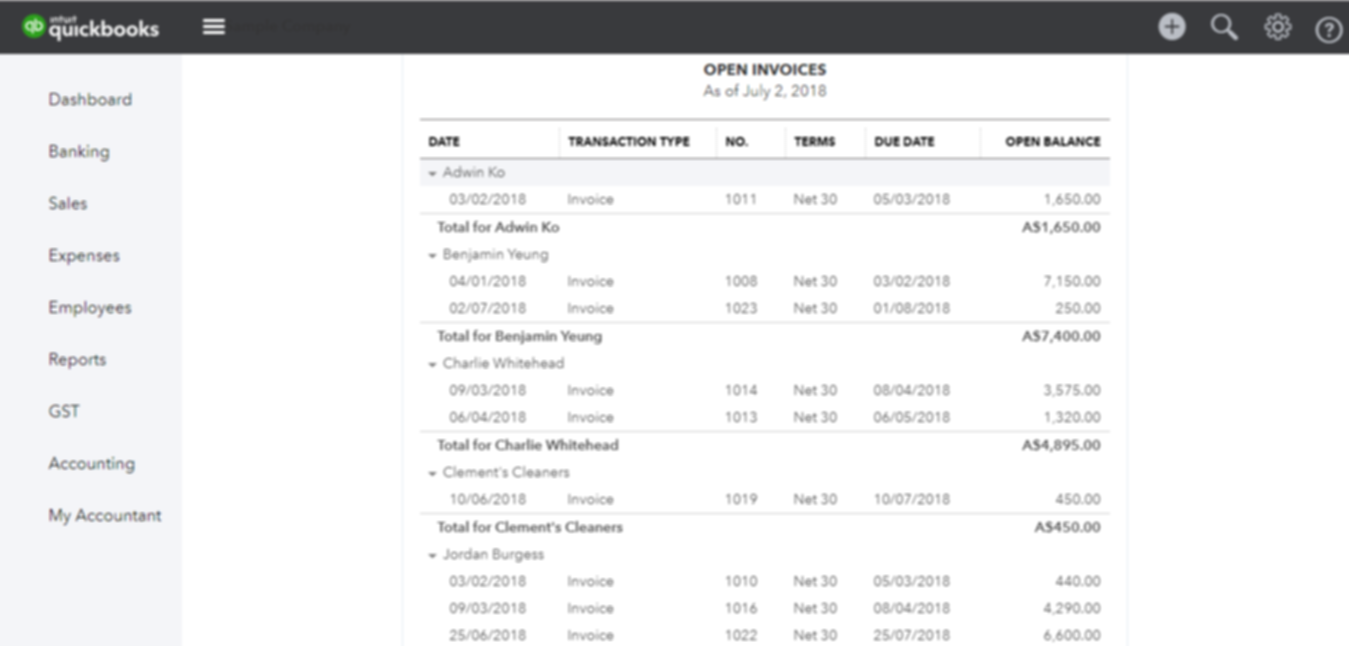

If you use QuickBooks Online, creating an invoice is super fast and easy. Watch this tutorial on invoicing on QBO here. (If you don't currently use QuickBooks Online, but like the look of their invoicing, get in contact to find out more)

Another way to create an invoice is by using one of the many free invoice templates from canva.com. Here is an example tax invoice I created from one of the templates on Canva:

You can also use Microsoft Excel or Google Sheets to create an invoice - we have included a downloadable tax invoice template for you to use. Simply populate the invoice with your information and you’re ready to go. Don’t forget to include the customer’s ABN if the taxable sale is $1000 or over. It is a good idea to convert the invoice to PDF before sending it on to your customer so that the invoice can’t be edited (to avoid confusion).

Free downloadable tax invoice template [.xlsx 4.07KB]